If your portfolio doesn’t include an investment with a Targeted Return of 25%-35% annually, it’s time to speak with Emmis about Direct Access to Secured Investments in emerging Pre-IPO growth companies.

Emmis further de-risks investments via its deal process partners, who perform thorough due diligence of each invested Company and often lead the successful IPO execution for the invested Company, so those Companies can focus on operations and growth.

All debt is Secured Convertible Debt – secured Company debt or equity, with a preferred payback.

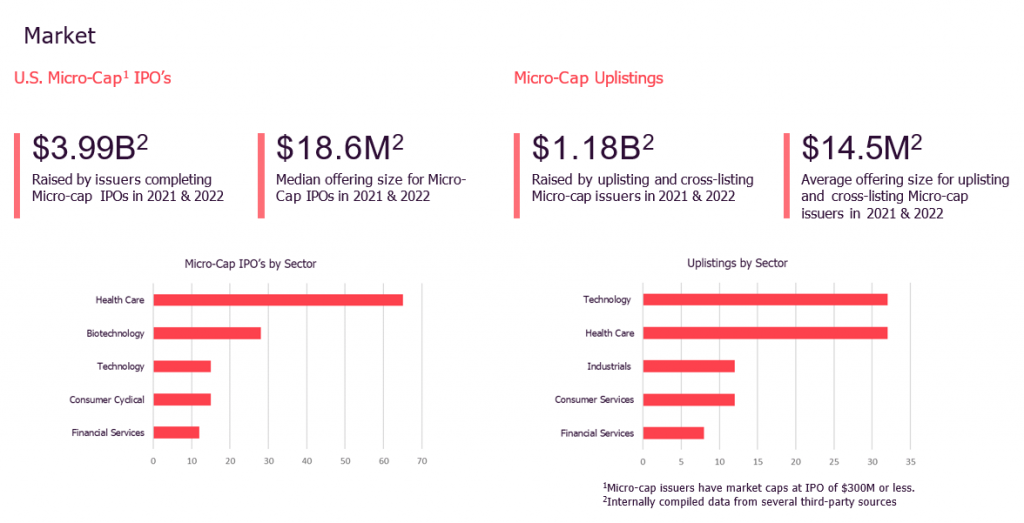

High-Growth Industries: Our pre-IPO investments target companies in high-growth sectors like technology, biotech, and disruptive industries, offering the potential for significant returns.

Favorable Entry Valuations: Investing before a company goes public allows Emmis to secure shares at a discount to the IPO price, maximizing potential gains.

Ability to Identify Winners: Our experienced management team has a strong track record of spotting promising emerging growth companies, increasing the likelihood of successful investments.

Active Management: Our boutique fund specializes in pre-IPO investing, ensuring that investments are thoughtfully selected, actively monitored, and optimized for growth.

Comprehensive Due Diligence: Our investment selection team conducts thorough due diligence, analyzing a company’s business model, competitive landscape, financial outlook, and current market intelligence to make well-informed investment decisions.

By investing with Emmis Capital, you gain access to the exciting world of pre-IPO opportunities, with the potential for substantial rewards in high-growth industries.

Best of all, Emmis’ pre-IPO company investments are Secured Convertible Notes, which receive preferential treatment in the worst-case scenario.

Your investment in Emmis Capital earns an annual 12% dividend, paid in quarterly increments, plus pro-rata shares of profits after a 2% annual management fee.

Emmis earns a 20% performance fee on all profits after a 12% investor dividend as well as a standard 2% annual management fees are distributed, until such time as the investors total returns exceed 30%, at which point the performance fee becomes 50% thereafter.

Emmis adheres to the documented investment criteria and the companies Emmis invests will become eligible to meet national stock exchange listing requirements, like the New York Stock Exchange or Nasdaq.

As of the beginning of Q4 2023, only 8 US hedge funds returned more than 40% per annum in the previous 3 years out of a staggering 3,926. Gaining access to these funds for smaller accredited investors is nearly impossible due to hefty minimum investment commitments.

Emmis’ low investment commitment and comparable targeted annual returns offer smaller accredited investors the potential for top hedge fund-like performance through secured Investments in emerging Pre-IPO growth companies.

Derived from the Hebrew word for Truth, Emmis embodies truth and transparency, and stands out as a boutique investment fund meticulously crafted for discerning high net worth individuals seeking unparalleled access to early-stage, pre-IPO investments.

We proudly set our sights on Total Investor Targeted Returns of 25-35% annually. With participation deliberately limited, we offer an exclusive gateway to investment opportunities historically reserved for Wall St. insiders, ensuring that Emmis investors are part of a distinguished circle capitalizing on the most promising companies poised for upcoming market breakthroughs, as well as national securities market IPOs.

Elevate your investment journey with Emmis Capital and align yourself with a fund that not only opens new avenues of investment opportunity, but propels you towards exceptional returns by leveraging the niche market needs of companies valued between $30-$100 million seeking to accelerate growth by accessing the millions of dollars awaiting them on Wall Street.

Innovation meets integrity at Emmis Capital. By helping issuer companies finance IPO administrative fees, Emmis helps build a solid foundation for its portfolio companies, ensuring a seamless and financially sound entry into the public markets. You’re investing in a future shaped by truth, innovation, and exceptional returns.

1. Very strict criteria: The foundational strength of the Emmis strategy lies with limiting investment to companies actively engaged in an Initial Public Offering on a senior exchange with a well-regarded investment bank, coupled with a short time horizon.

2. Emmis’s deal structure maximizes investment security while minimizing risk: The risk mitigation strength of the Emmis transaction structure lies in the issuance of secured debt.

3. Emmis’s deals typically include Material Equity ‘Kickers’: A strength of the Emmis return strategy lies in the issuance by the Company of equity at a discount to the IPO price and in the quantum of shares and/or warrants received.

Love to Identify and Exploit Niche High-Return, Low-Risk Investments

Read How the Experts at Emmis Capital are bringing Integrity and Transparency to Small and Micro-Cap Pre-IPO Financing while Capturing Exceptional Returns

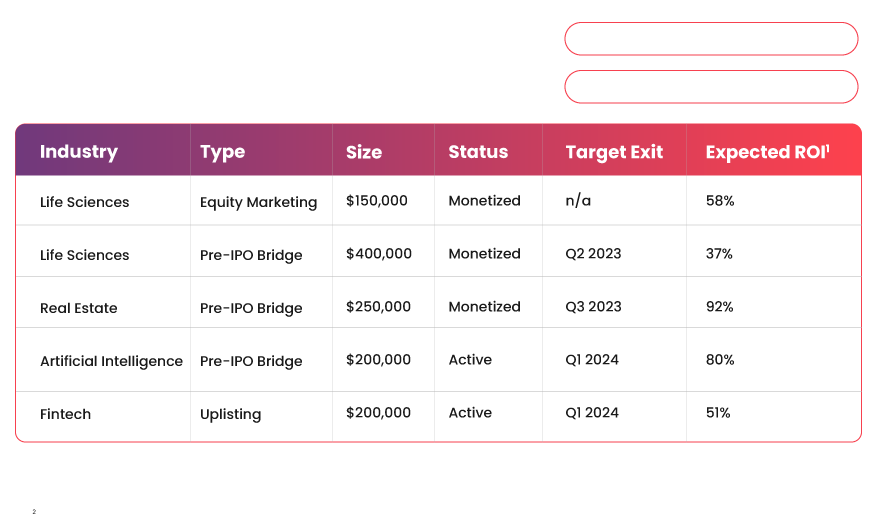

Emmis’s proven investment criteria, model and terms are ideal for investors seeking significant returns while minimizing risk. With a targeted investor ROI of 25-35% and a goal to turn investments 1.5 – 2 times per annum, this strategy offers the potential for exceptional investor returns. Additionally, the promise of 12% annual qualified dividends, paid quarterly, ensures a steady income stream.

Issuer

Fund Size Target

Investment Strategy

Target Portfolio Companies

Focused Business Sectors

Business Type

Check Sizes

Target Rate of Return

Quarterly Dividend

* see PPM for full fund details (link to PPM).

Emmis Capital, LLC

$10,000,000

Pre-IPO, IPO, Uplisting and PIPE investments

Global Companies committed to listing on Nasdaq or NY Stock Exchange or other Senior Exchanges

Technology in Health and Finance, Renewables, Consumer Goods

Emerging growth, demonstrable execution, business transformation, M&A/Rollup

$50,000 to $1m

25% to 35%

3% per quarter (12% annualized)